还呗逾期会被起诉吗真还不上怎么办

Title: Potential Consequences of Overdue HengBei Loans and How to Handle Them

Introduction:

In today's fast-paced financial world, loan repayment is a crucial aspect of maintaining good financial health. However, circumstances may arise where one is unable to pay back their loans in a timely manner. This article aims to explore the potential consequences of overdue HengBei loans and provide some recommendations on how to address this situation.

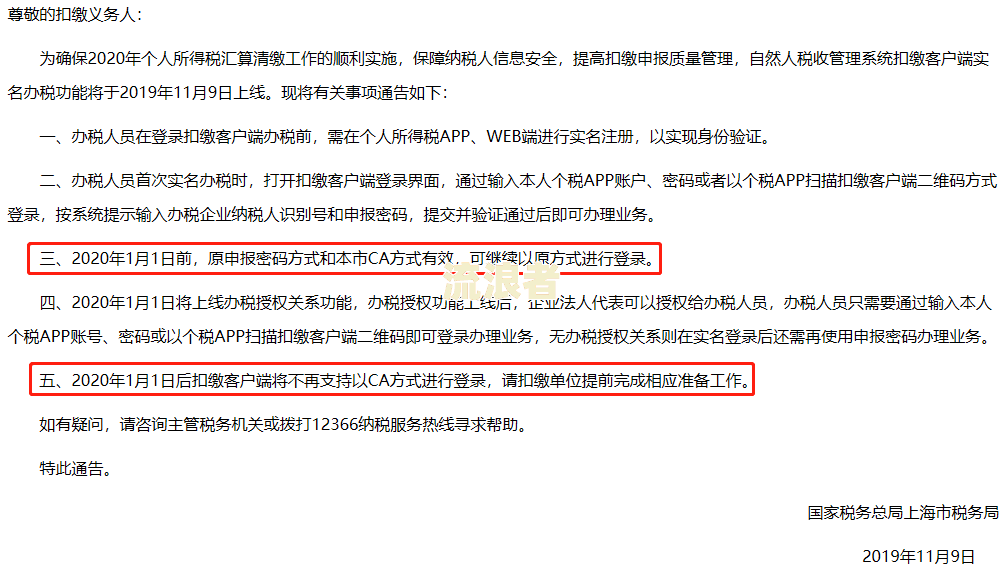

1. Understanding the Potential Legal Ramifications:

When an individual fails to repay their HengBei loan on time, there is a possibility of legal consequences. HengBei may have the right to take legal action against the borrower if all efforts to resolve the situation have failed. It is therefore important to be aware of the potential legal proceedings.

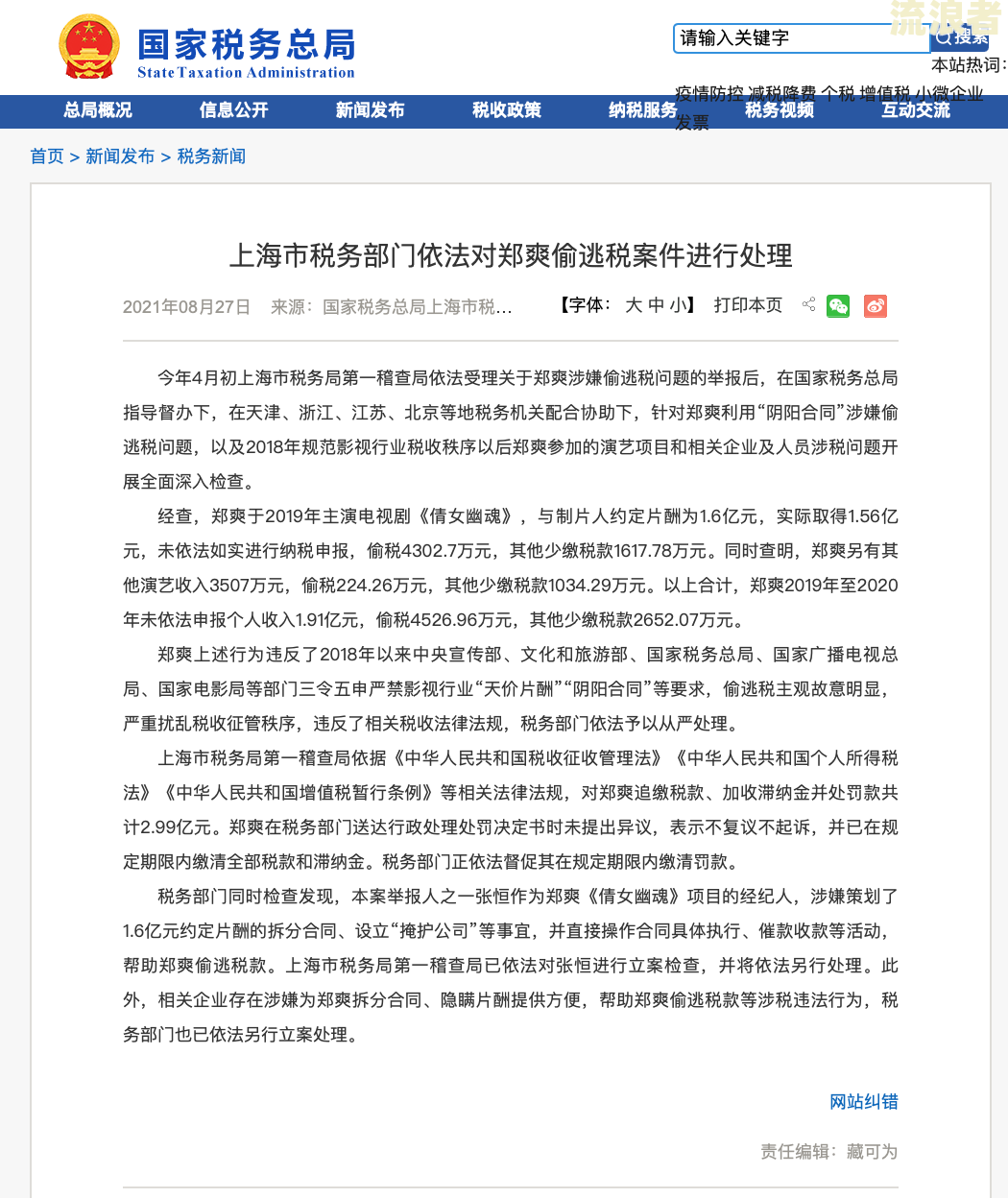

2. Consequences of Being Sued for Overdue HengBei Loans:

If HengBei decides to file a lawsuit against the borrower, it can result in a range of consequences. These may include:

- Damage to Credit Score: The lawsuit can negatively impact the borrower's credit score, making it difficult to obtain future loans or credit.

- Legal Costs: The borrower may be responsible for paying various legal fees, such as court filing fees and attorney fees.

- Seizure of Assets: If the borrower loses the lawsuit, HengBei may potentially have the right to seize assets as collateral to repay the loan.

3. How to Handle Overdue HengBei Loans:

When facing difficulties in repaying an overdue HengBei loan, the following steps can be taken:

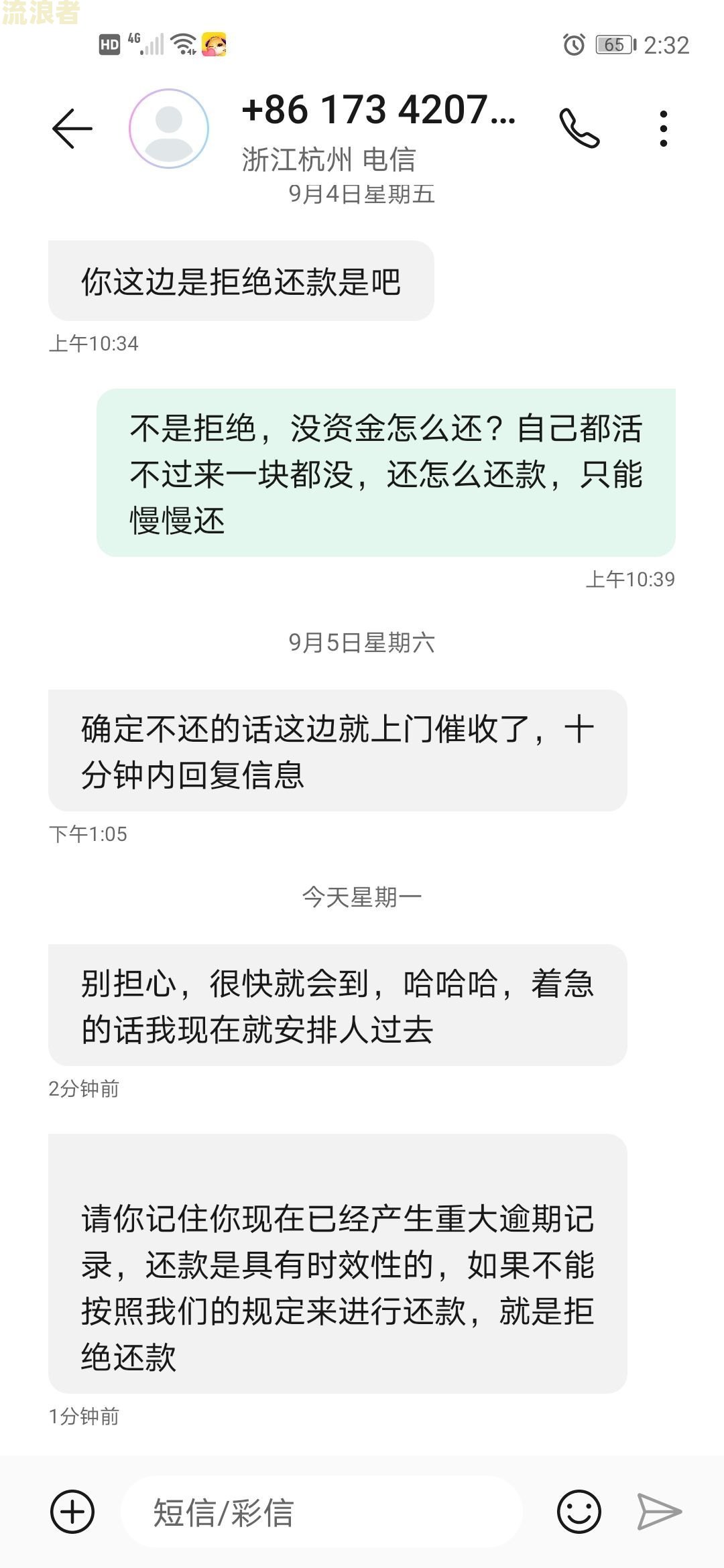

a. Communication:

It is essential to maintain open lines of communication with HengBei. Inform them of the situation and discuss potential solutions, such as renegotiating the loan terms or establishing a new repayment plan.

b. Seek Professional Assistance:

If the situation becomes overwhelming, it may be beneficial to seek professional help, such as credit counseling services or legal advice. These professionals can provide guidance on negotiating with HengBei and exploring alternative repayment options.

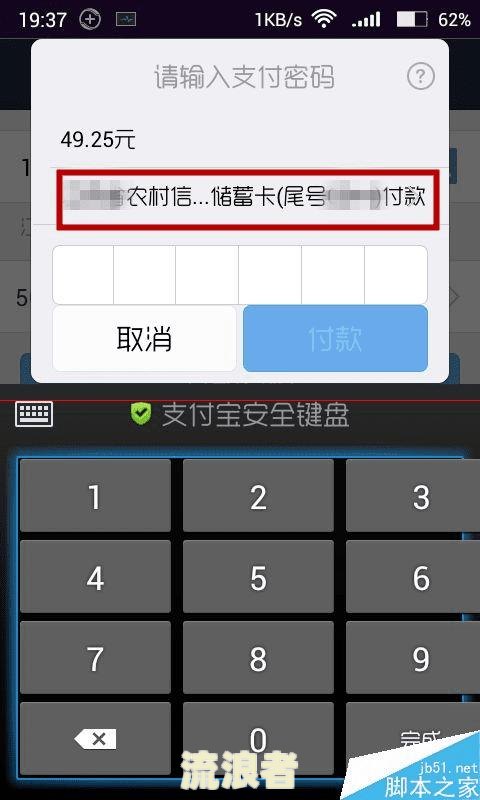

c. Explore Loan Modification:

In some cases, HengBei may be willing to modify the loan terms to accommodate the borrower's financial situation. This could involve reducing the monthly payment amount or extending the loan term. It is worth discussing this possibility with HengBei directly.

d. Review Personal Finances:

Take a comprehensive look at personal finances to identify areas where expenses can be reduced. This may involve cutting back on non-essential items or seeking additional sources of income to make loan repayments more manageable.

Conclusion:

While facing the consequences of overdue HengBei loans can be daunting, it is important to remember that proactive communication and seeking professional assistance can help find viable solutions. It is crucial to take proactive steps to address the situation rather than avoiding it, as this can prevent further legal complications and long-term financial damage.

精彩评论

◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。

窗前明月光

窗前明月光

最新评论