房贷逾期多久会冻结房产

房地产市场的快速发展使得购房成为了很多人实现财富增长的手之一,然而购房并非是一件轻松的事情,多购房者需要通过贷款才能够负担得起房屋的购买。然而,随之而来的是房贷逾期的风险,一旦逾期时间过长,房产就有可能被冻结。那么,房贷逾期多久会冻结房产呢?

房贷逾期多久会冻结房产?

房贷逾期多久会冻结房产证?

房贷逾期多久会冻结房产账户?

房贷逾期多久会冻结房产?

房贷逾期多久会被冻结账户?

房贷逾期期限的具体长短并没有一个固定的标准答案,因为在不同国家和地区的法律法规中可能存在差异。然而,一般来说,银行或金融机构在贷款合同中会对逾期还款给出明确的规定。

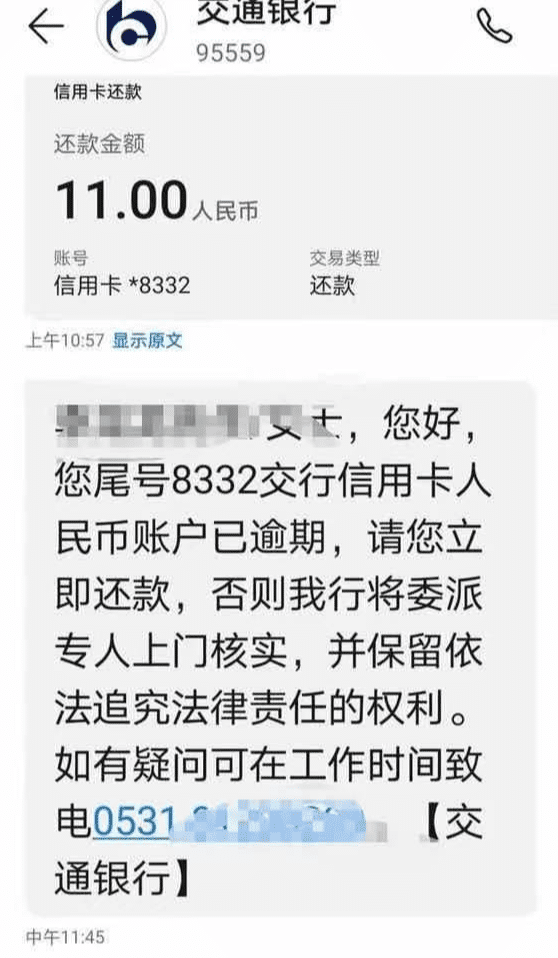

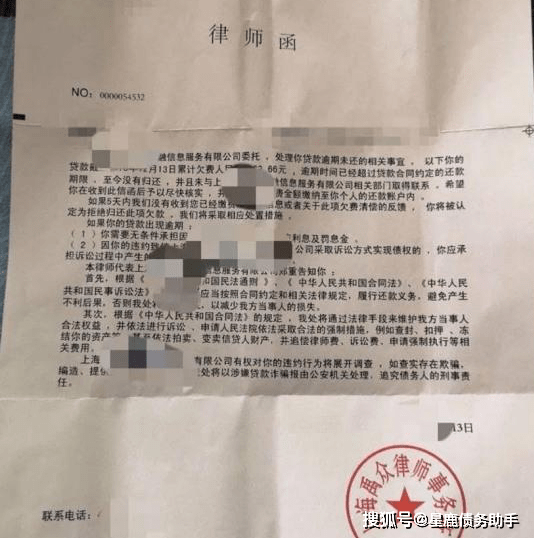

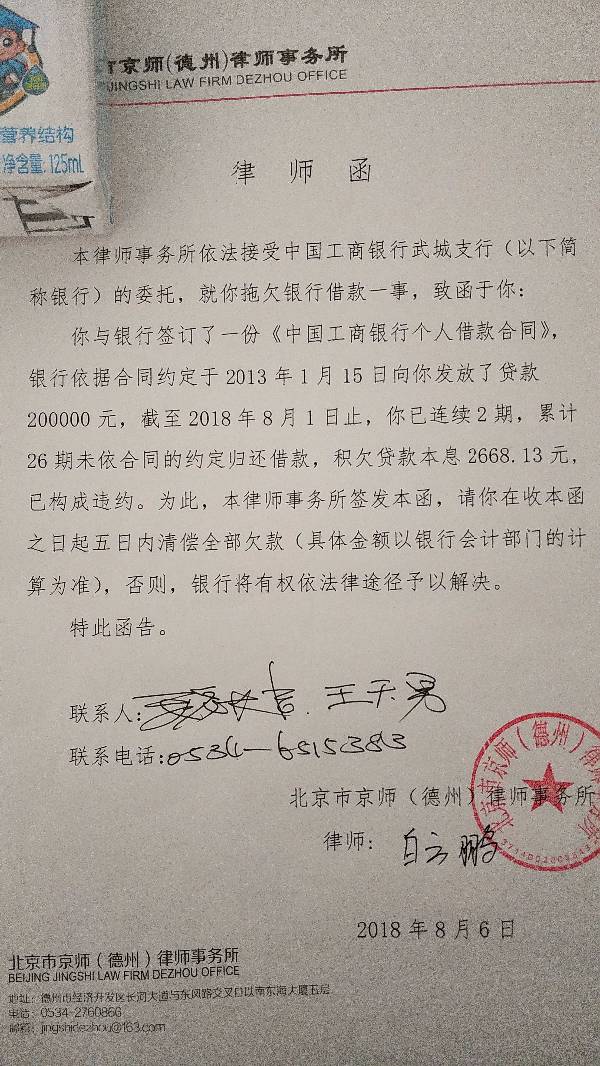

房贷逾期会冻结房产的时间节点通常在贷款逾期后的三个月到一年之间。如果贷款逾期时间不超过三个月,银行通常只会采取催收措,通过电话催收、邮件提醒等方式来要求借款人尽快还款。

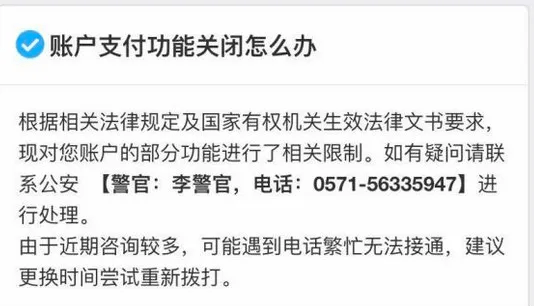

当贷款逾期时间超过三个月但不超过一年时,银行有可能会采取强制措,例如冻结借款人的银行账户。通过冻结账户,银行可以在借款人还款之前确保自己能够优先获得贷款偿还。此时,借款人将无法从冻结的账户中进行取款、转账等操作,直至还款完或与银行达成新的还款安排。

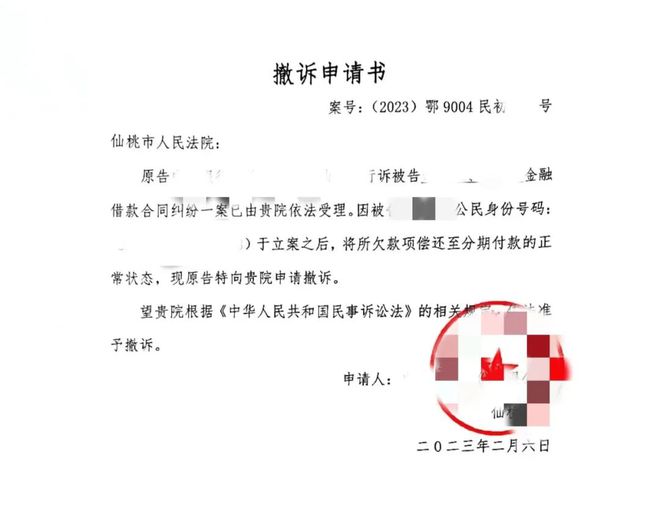

如果贷款逾期时间超过一年,银行可能会采取更严的措,例如将房产证冻结。房产证冻结意味着借款人无法变卖或转让房产,直至还清所有逾期款。这给借款人带来了更大的压力,因为除了需要偿还逾期款外,还要承担房产无法正常流通的风险。

总而言之,房贷逾期时间越长,银行采取的强制措就越严。贷款逾期三个月可能会导致账户冻结,一年之后有可能会导致房产证的冻结。因此,借款人应尽早与银行沟通,寻求解决方案,避免逾期时间过长,以免造成更大的损失。同时,购房者在选择贷款时也要充分考虑自身还款能力,以确保能够按时还款,避免逾期的风险。

In conclusion, the duration of a mortgage overdue determines whether a property will be frozen. While the specific time frame may vary depending on the laws and regulations of different countries and regions, it is generally between three months and one year. If the overdue period is less than three months, the bank typically implements collection measures to prompt the borrower to repay the loan. However, if the overdue period exceeds three months but does not exceed one year, the bank may resort to freezing the borrower's bank account. In more severe cases where the overdue period is over one year, the bank may proceed to freeze the property deed. It is crucial for borrowers to communicate with the bank as early as possible and seek solutions to avoid lengthy overdue periods and potential property freezes. Additionally, prospective homebuyers should carefully consider their repayment capabilities when choosing a mortgage to prevent the risk of default.

精彩评论

◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。

请叫大哥

请叫大哥

最新评论